Enterprise Education

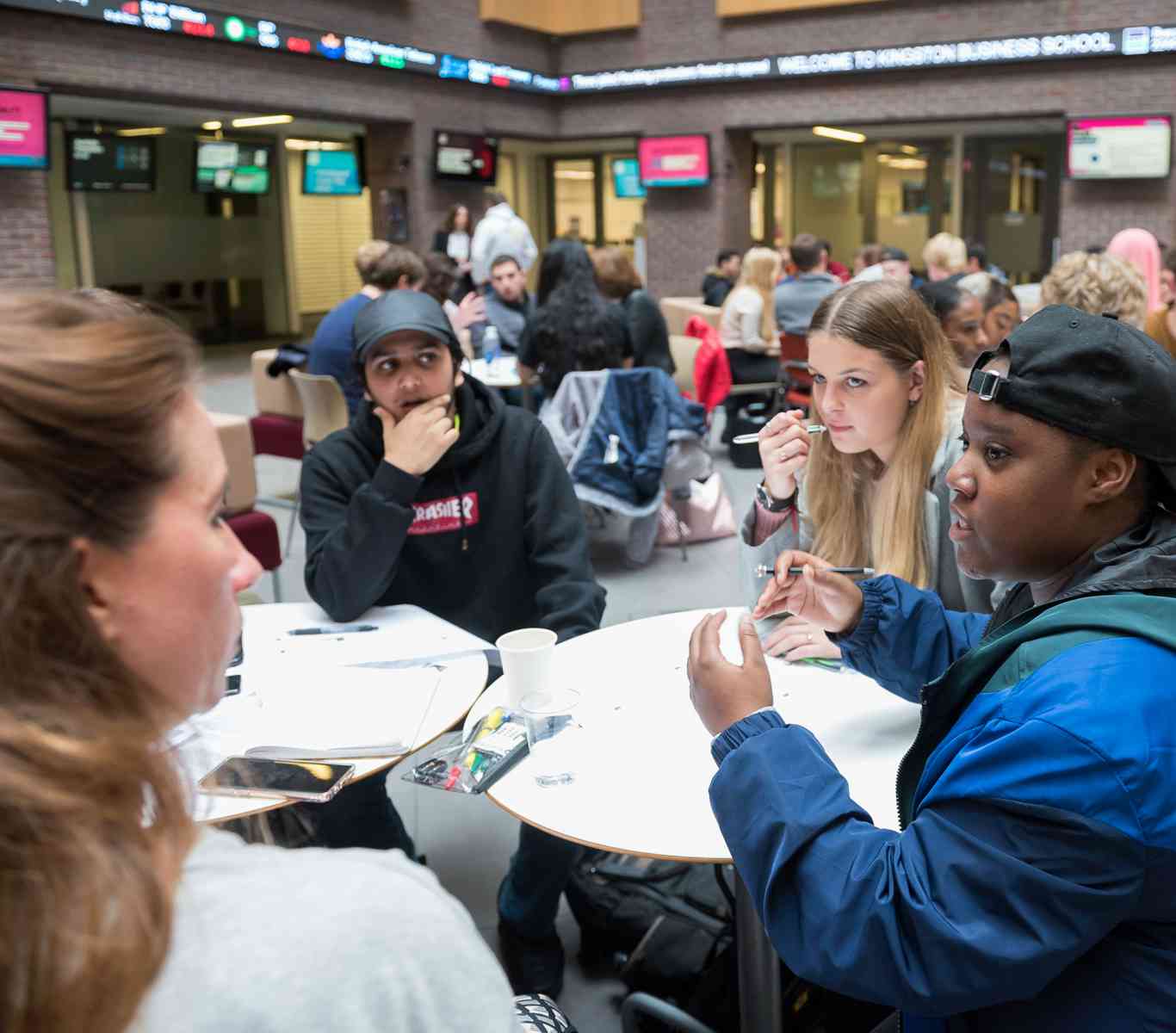

Enterprise Education develops vital skills that will help students grow personally and professionally and promote themselves and/or their business idea. These skills and an entrepreneurial mind set are crucial for any future career option. For the eighth year running, Kingston University has been rated amongst the top two most successful UK higher education institutions for graduate start-up companies (Higher Education - Business and Community Interaction Survey).

Enterprise Education is not limited to just business students or students who want to set up their own business. Anyone who wants to develop innovation skills or try something new, is welcome. Whether students are looking to develop skills, an idea, or a business start-up, the Enterprise Education programme at Kingston University is here to help.

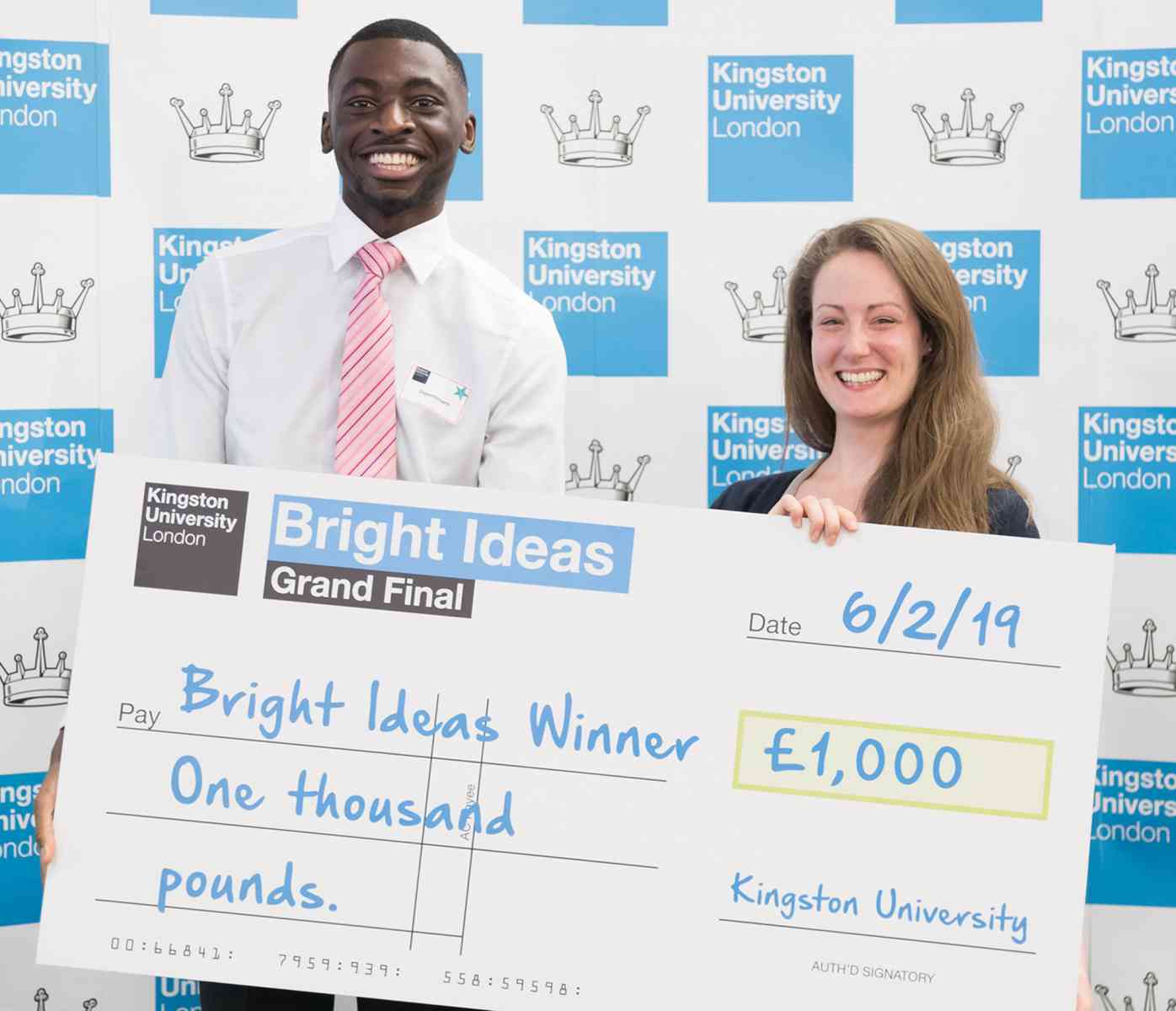

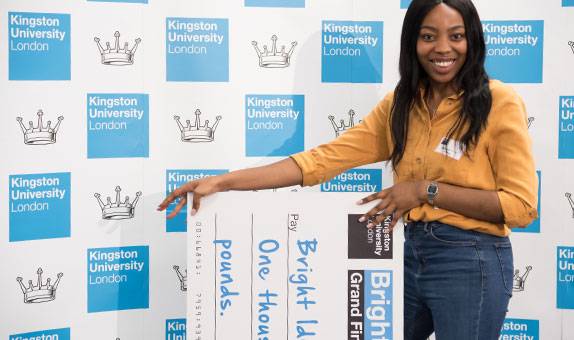

Bright Ideas

Bright Ideas is an annual competition designed to give our students the opportunity to develop an idea, have it evaluated and win a prize of up to £1,000.

Workshops and events

Our workshops and events provide networking opportunities with distinguished entrepreneurs, business experts and like-minded students.

Mentoring

Our mentoring programme provides free support and encouragement needed to help students get their ideas off the ground.

Hackathons

The HackCentre programme, set up in partnership with Santander Universities Enterprise and Entrepreneurship Fund, encourages students to explore solutions to real-world scenarios.

The Nest

The Nest is Kingston University's incubation space for student and graduate entrepreneurs who are ready to accelerate their business to the next level. Our start-up community offers facilities, services and investment opportunities specifically designed to boost growth and innovation. If you'd like to join the Nest, get in touch.

Competitions

As well as our own Bright Ideas, we give our students access to a variety of competitions, such as the Santander Universities Entrepreneurship Awards, which is one of the UK's largest student and graduate business pitching events, where students can win £25,000 funding to kick-start their business!

Funding

If you are seeking support in making your business idea a reality, then the Enterprise Fund is here to help. Successful applicants can be awarded up to £500 to develop an idea. The university also has its own Crowdfunding platform, KUBacker.

My experience at enterprise was, and will be, very important for my future career and business development. The team gave me the tools to be successful, has inspired me and encouraged me to go the extra mile.

Louisa, Midwifery student

I would definitely recommend this experience to others. The skills you learn and develop will enrich your CV and benefit you in your future career.

Hung, Engineering student

Get involved

Kingston University students' creative ideas to breathe life back in to local economy

Top 3 tips for student entrepreneurs

Contact us

If you have any questions about the Enterprise Education programme, please email us and we will get back to you as soon as possible.